Documents Required For GST Registration

Documents Required For Individual/Proprietor GST Registration

- Pan card

- Passport size photo(not to be older than 2 months)

-

Address Proof (not to be older than 2 months)

- Aadhaar card

- Electricity bill

-

Residential Proof (not to be older than 2 months)

- Bank statement

- Electricity bill

- Telephone bill

- Active Mobile number and Mail Id

-

Documents for Registered Office

The registered document of the title of the premises of the registered office in the name of the proprietorORThe notarized copy of lease / rent agreement in the name of the proprietor and trade name(if any) along with a copy of rent paid receipt not older than one month. -

The authorization from the Landlord (Name mentioned in the Electricity Bill or Gas Bill or Water Bill or Property Tax Receipt or Sale Deed) to use the premises by the proprietor as its registered office. This is usually referred to as NOC from Landlord.ANDProof of evidence of any utility service like telephone, gas, electricity, etc. depicting the address of the premises in the name of the owner or document, which is not older than two months.

Documents Required for GST Registration (Partnership Firm)

Documents Required for GST Registration (Company)

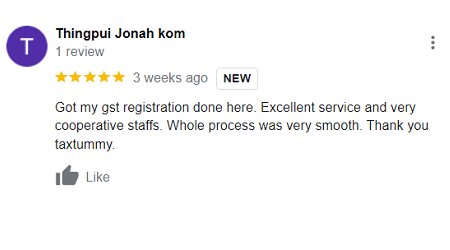

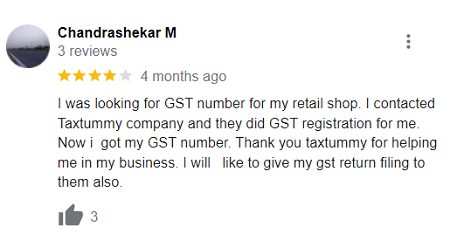

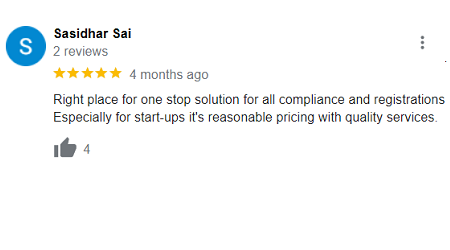

Our Happy Customers

According to the World Bank, 63.4 Million MSMEs in India Face Challenges in Securing Affordable and Trustworthy GST Registration and Compliance Services - Are You One of Them?

Welcome to taxtummy.com - Your GST Registration & Compliance Partner

Are you a business owner or shop owner in India, struggling to find affordable and reliable GST registration and compliance services?

At taxtummy.com, we're here to revolutionize the way you manage your GST and other tax-related requirements, without the hassle of travelling long distances or paying exorbitant fees.

Our expert team of tax consultants and Chartered Accountants is committed to delivering top-notch services at a fraction of the cost compared to traditional services offered by local agents. We understand the unique challenges faced by MSMEs and entrepreneurs like you, and we're here to make your life easier.

Why choose Taxtummy?

FREE Consultation:

Are you a business owner or shop owner in India, struggling to find affordable and reliable GST registration and compliance services?

Comprehensive Services:

Besides GST registration and compliance, we offer a wide range of allied services, including trade licensing, shop licensing, and more.

Affordable Pricing:

Our competitive pricing makes us the perfect choice for small businesses and shop owners who want quality services without breaking the bank.

Remote Services:

No need to travel long distances for tax consultations. Our online platform allows you to access our services from the comfort of your home or office.

Secure & Confidential:

Your sensitive financial data is safe with us. We prioritize data security and ensure the utmost confidentiality for our clients.

Business Growth:

Our services are designed to help your business stay compliant and focus on growth, while we handle the complexities of GST and other tax-related issues.

Take the first step towards hassle-free GST registration and compliance today!

Challenges Encountered by Business Owners in India When It Comes to Filing Their GST & Compliance :

1.

Business owners often have limited knowledge and understanding of the complex GST and licensing processes. This can lead to errors, confusion, and not following the regulations, which can result in penalties and fines.

2.

Businesses located in Tier-2 cities and rural areas often find it hard to get access to cost-effective and high-quality professional services. This means they have to travel long distances or be content with local, less qualified professionals.

3.

The high costs of professional tax and licensing services can be a real burden on small & medium businesses with limited budgets, which often discourages them from seeking the necessary help to remain compliant and avoid fines.

4.

Business owners often find it difficult to make time and access the resources they need to fulfil GST filing and licensing requirements, as they are already busy managing the regular operations of their business.

5.

Due to the frequent changes in regulations such as GST , licensing regulations etc., it is challenging for business owners to keep up with the most recent regulations and obligations.